By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the February 2018 edition of NTEA News.

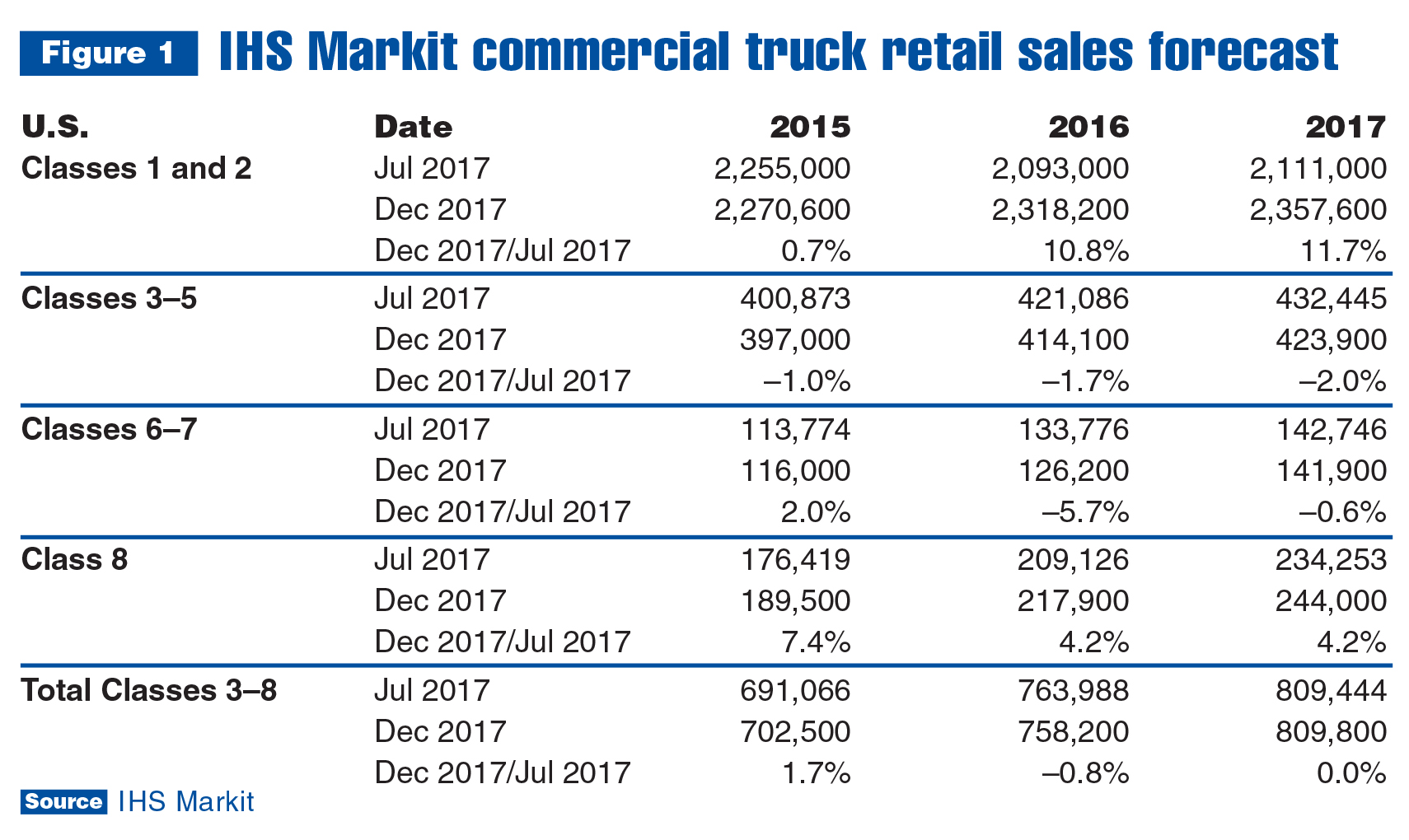

IHS Markit’s December 2017 commercial truck chassis sales forecast for 2018 was a bit brighter than in July. The Class 3–8 total increased by more than 10,000 units — from 691,066 to 702,500. The forecast did not improve for all weight classes, though.

Figure 1 shows sales projections (in units) from IHS Markit’s July and December 2017 updates. The percent change data is the difference between the July and December forecasts — not the estimated annual percent change for the year. In Classes 1–2 and 8, expectations for 2018 have improved, but were lowered for Classes 3–7.

Sales are still expected to increase in Classes 3–7 — just not as much as previously anticipated. In fact, sales are projected to rise in all weight class groups this year: 17,000 units in Classes 3–5; slightly more than 10,000 units in Classes 6–7; and about 28,000 units in Class 8. This would mean an almost 55,000-unit addition to the 2017 sales total. It sounds like a lot, but in Class 8, 218,000 units is well below the 2006 record of almost 300,000 units. There is still room for more growth.

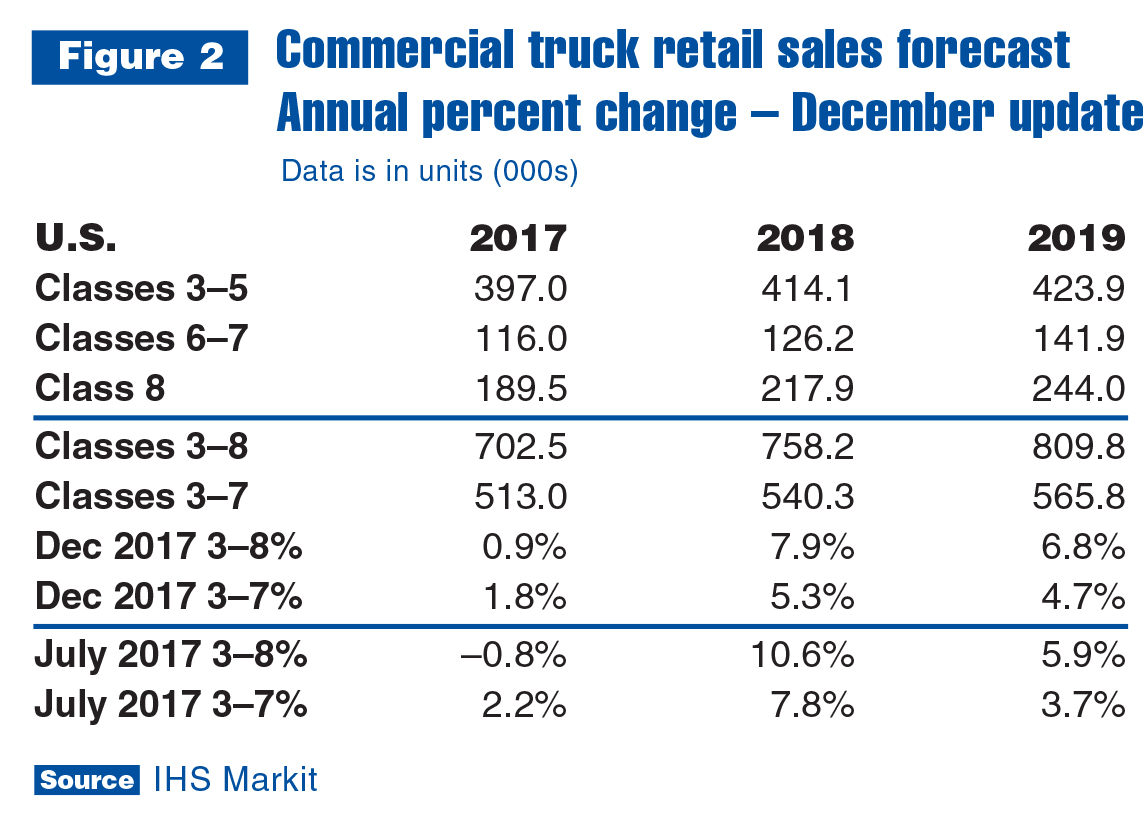

Figure 2 also includes a July–December forecast comparison, but shows the actual annual percent change. Class 3–8 sales are now thought to have grown faster in 2017 (0.9 percent) than was predicted in July (–0.8 percent). This is due to much faster growth in Class 8 than previously anticipated. And Class 8 is expected to be the primary driver of growth in 2018 and 2019.

What does it all mean?

In sum, truck chassis sales are expected to grow faster in 2018 than in 2017. Projections have tapered a bit for Classes 3–7 — especially for Class 5, in which sales have already exceeded prerecession levels. Class 8 will probably grow much faster than the rest of the industry this year and next.

The primary takeaway for the work truck industry is that there are likely two more years of growth for which to plan. The rate of growth will accelerate in 2018 and start decelerating in 2019.

If you have questions about this article or the IHS Markit forecast, email me at stevelk@ntea.com.

For more industry market data, visit ntea.com/marketdata.