Guest editorial

By Dr. Albert D. Bates, Director of Research, Profit Planning Group

This article was published in the December 2017 edition of NTEA News.

Most businesses think they fall short of desired cash levels, but they probably have more than enough to operate successfully, even in a slow-growth economy. The challenge is if another serious economic downturn occurs, their cash balances could disintegrate.

Due to this lack of cash, many companies made significant moves over the last decade in an attempt to generate cash. However, instead of focusing on improving profitability to increase cash, a majority reduced inventory and accounts receivable at the existing profit level. Such actions have created as many problems as they have solved.

Alternative approaches for increasing cash

There are two different approaches to increasing cash for distributors. The first is to systematically increase profit and reinvest the after-tax profit back into the business. The second is to reduce what are commonly called cash traps, with the most obvious being inventory and accounts receivable. These two methods — profit and cash traps — have mirror-image strengths and weaknesses.

Increasing profitability, which requires focusing on a number of profit drivers, has a slow payoff. The advantage is that profit improvements tend to become permanent events, helping increase cash balances every year as long as results are maintained.

In contrast, reducing inventory and/or accounts receivable may cause cash to grow sharply and quickly. This decrease could lead to a sales decline if the changes are not made precisely. For example, the firm may cut back on the line of credit provided, even to good customers. Further, it may lower the inventory investment in key items, leading to severe out-of-stock situations.

A lot of companies see only the upside — the quick-hit increase in cash from reducing inventory and accounts receivable. Any subsequent decline in sales often leads to unwelcome surprises regarding profitability that can be difficult to overcome.

Cash and profitability

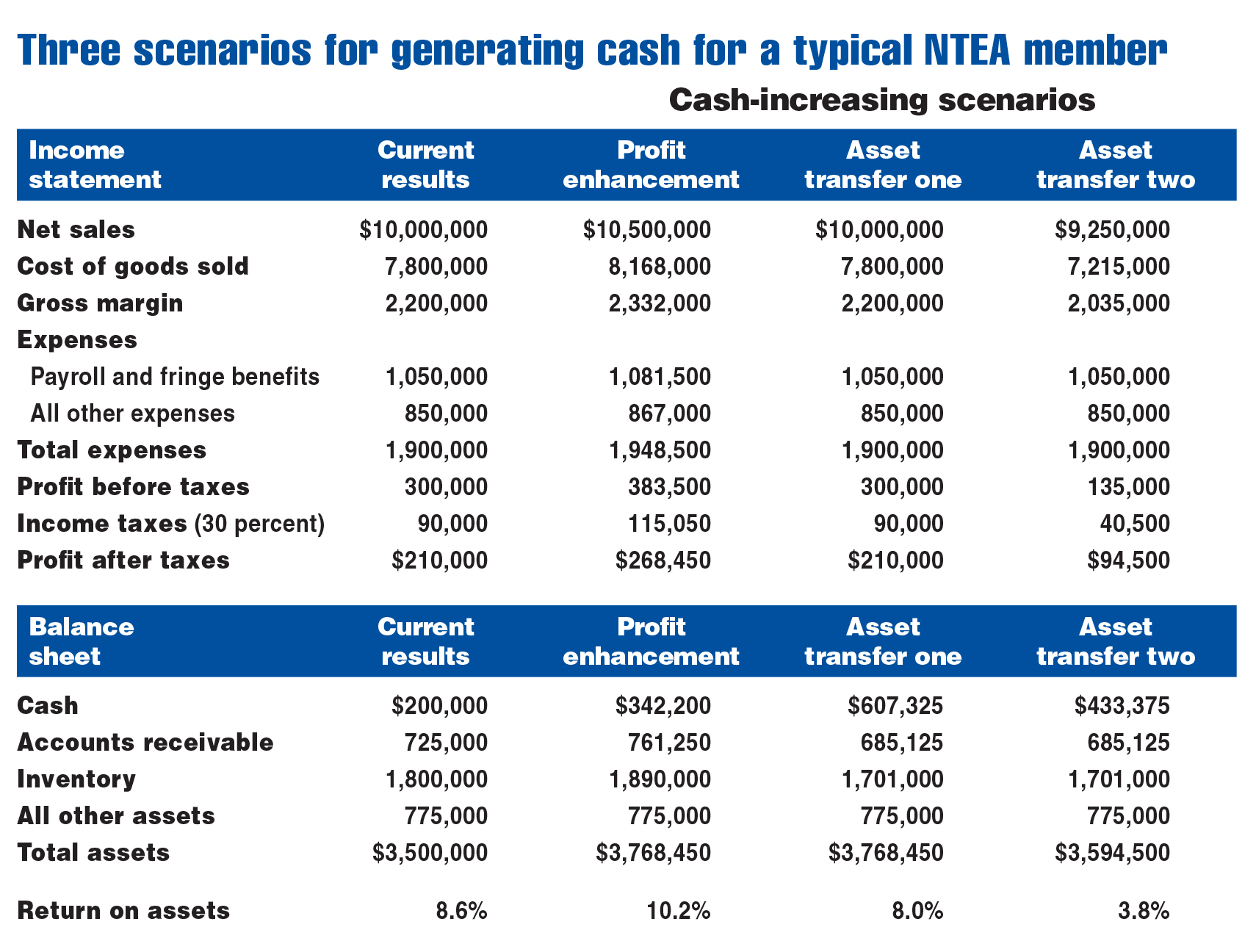

The chart below analyzes alternative approaches to increasing cash. The first column (current results) presents information for a typical NTEA Distributor member. As shown, the company generates $10,000,000 in sales, resulting in a pre-tax profit of $300,000. It pays a 30 percent tax rate, so it produces $210,000 in after-tax profit to reinvest in the business. The firm’s industry-average gross margin is 22.0 percent, and its expenses are dominated by fully-loaded payroll costs.

On the investment side, total assets are $3,500,000. These are heavily weighted toward accounts receivable and inventory. Cash is $200,000, which represents 5.7 percent of total assets. This is strong, but more is always wanted. Return on assets (pre-tax profit divided by total assets) is 8.6 percent.

Profit enhancement

The next three columns in the chart present options for improving cash position — the first of which is systematically improving profit position. In this scenario, four realistic actions have been taken. Sales increased by 5.0 percent; gross margin dollars rose by 6.0 percent, reflecting a modest margin improvement; payroll was controlled and increased by 3.0 percent; and all other expenses were leveraged so that they only increased by 2.0 percent. The result is an after-tax profit of $268,450 which is reinvested in the company to enhance the cash position.

With this approach, inventory and accounts receivable increase by the same 5.0 percent as sales. The result is that not all of the increased profit ends up in cash. A portion is invested in more inventory and accounts receivable. The most significant impact is return on assets rises to 10.2 percent. The business has a new profit base.

Asset transfer one

In this scenario, the company merely duplicates base-year profit results, as all emphasis is on asset redeployment. As such, accounts receivable and inventory are lowered by 10.0 percent.

Reductions in inventory and accounts receivable are transferred to cash along with the after-tax profit, which causes the firm’s cash position to explode. Cash increases by 303.7 percent to $607,325. It’s a great scenario, but typically proves unrealistic.

Asset transfer two

This final example reflects the result if inventory and accounts receivable reductions also produce a sales decline. Research suggests a sharp 10.0 percent decrease in inventory and accounts receivable will likely lower sales by around 7.5 percent. There is wide variation in this result, but that figure is fairly typical.

Gross margin dollars fall by the same 7.5 percent, creating a serious profit challenge. This is intensified by the fact that expenses tend to stay the same. The net result is after-tax profit falls to $94,500.

Although the company’s cash position is enhanced, with the reduction in inventory and accounts receivable, return on assets plummets to 3.8 percent at the same time. The business also set a lower profit base that will continue to be an issue in the long term.

All of this simply means extreme care must be exercised in any asset-redeployment strategy. The siren song of more cash may prove to create unanticipated consequences that erode the benefits.

Moving forward

Investment reduction strategies are popular today. If implemented properly, they can help improve a business’s cash position. However, in far too many instances, the investment reduction leads to serious sales volume problems. In a majority of cases, companies would be better served by focusing on the slow-but-steady approach of profit improvement to eventually produce more cash.

For access to additional industry statistics, visit ntea.com/marketdata.