By Joy Knesnik, NTEA Communications Manager

This article was published in the May 2018 edition of NTEA News.

In the last year, the work truck industry has experienced a strong business climate. Despite significant challenges, including natural disasters that swept across North America, the commercial vehicle community keeps pulling together and building momentum. Sectors like the construction market are thriving. Many companies are starting to develop strategic plans for the year ahead, identifying ways to navigate current dynamics and reach full potential. NTEA provides members with timely market data to support their tactical efforts and keep them aware of hiring prospects, sales levels and business growth patterns.

NTEA regularly seeks input from Distributor and Manufacturer member companies to evaluate current business and expectations for the future.

This article summarizes most recent survey results, integrating data from previous research initiatives for year-to-year comparisons and directional trends. The next survey will be emailed to Distributor and Manufacturer members in February 2019.

Compiled data from this year’s survey covers:

- Sales levels and quoting activity

- Backlogs

- Production capacity

- Employment levels

- Key factors influencing member businesses

- Upcoming challenges and opportunities

Survey findings

Sixty-five percent of respondents are distributors, and 35 percent manufacturers. Annual sales range from less than $2 million to more than $70 million, with the largest group representing $2–5 million (26 percent). Main product groups that at least 55 percent of respondents plan to sell in 2018 include toolboxes, flatbed/stake bodies, service bodies, liftgates, lights/warning devices/cameras and dump bodies. Overall survey data reveals strong sales levels and positive business expectations.

Upon considering a series of application markets, at least half of respondents noted the construction and government/municipal sectors increased in significance to their business in the last year. Not surprisingly, in the same timeframe, results indicate the construction sector was the best performing application market in terms of total sales. Participants noted construction and government/municipal as most important to their business moving into 2018 (retail trade was a distant third).

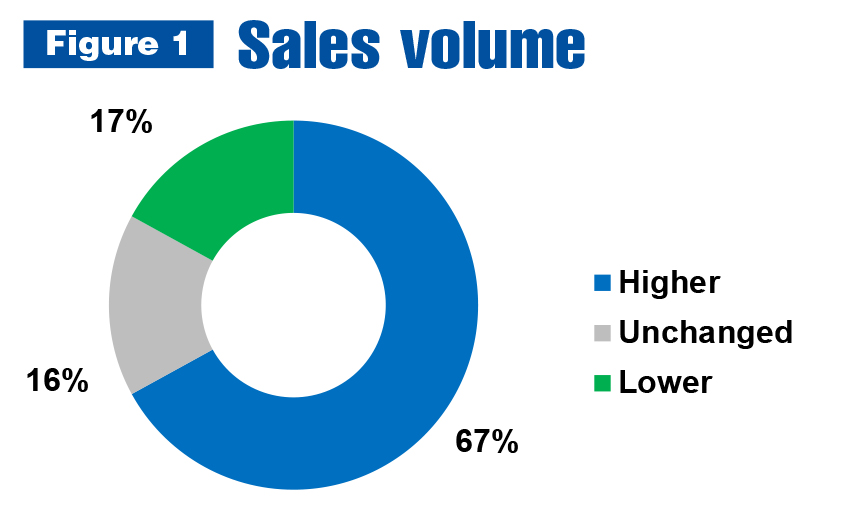

More than 65 percent of survey respondents registered higher sales in 2017 relative to 2016, while 17 percent reported a decline.

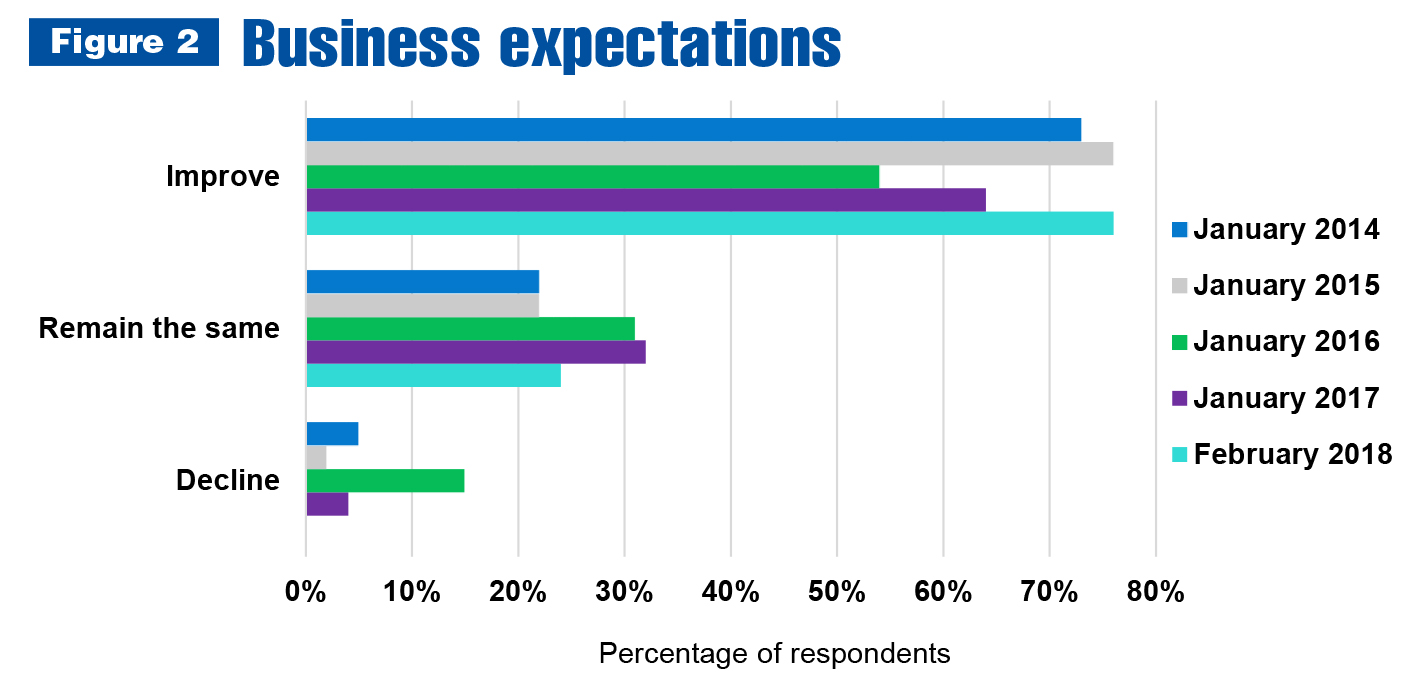

Seventy-six percent plan on business improving in 2018 — a return to the level reported in January 2015. Expectations seem optimistic, with no respondents anticipating a reduction.

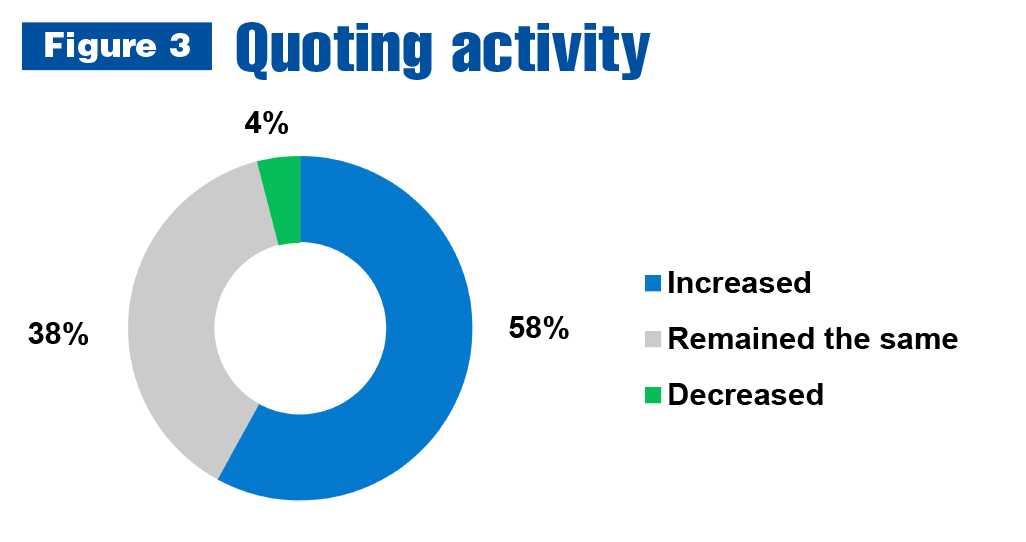

Fifty-eight percent noted increased quoting activity since July 2017. Thirty-eight percent said levels stayed flat, and just 4 percent identified a decrease.

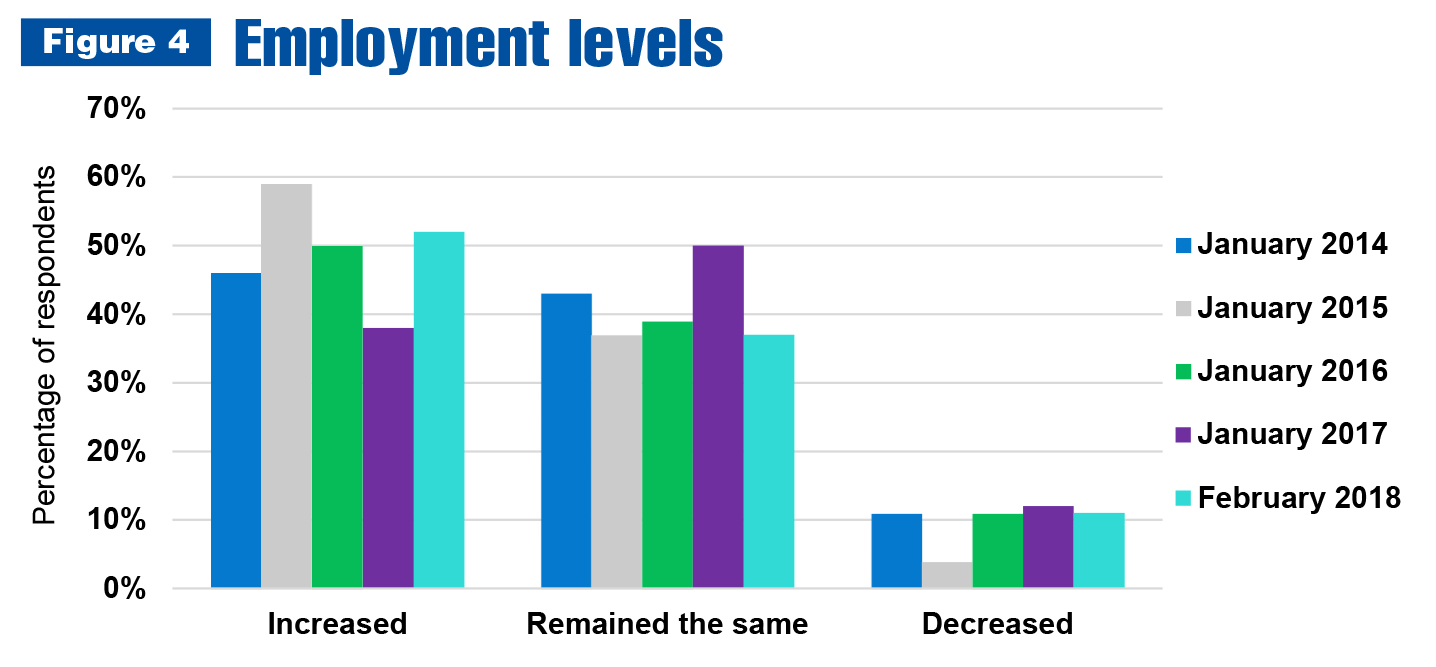

A majority of participants indicated higher employment levels since July 2017. Only 11 percent observed a drop in staffing.

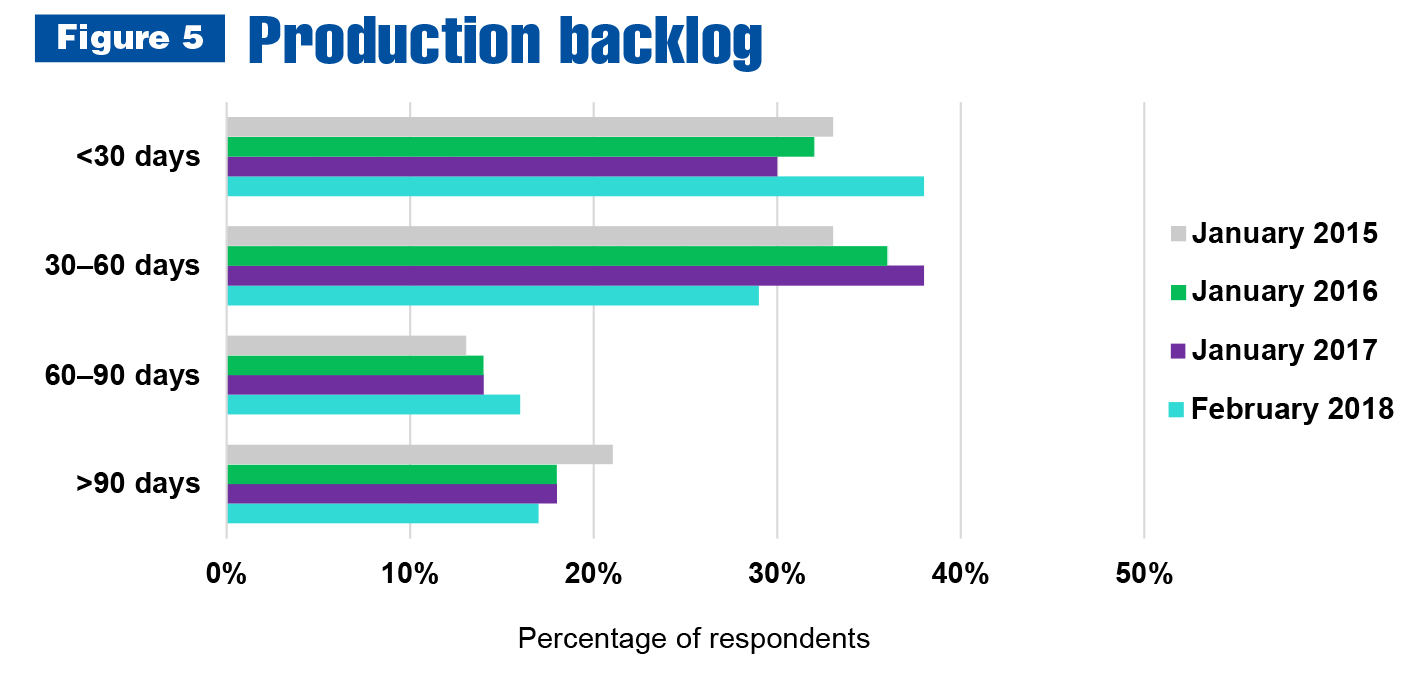

More than three quarters of survey respondents are dealing with business backlog. Half of those with backlog indicated current levels have increased as compared to July 2017, while another 45 percent said the status stayed about the same.

Thirty-eight percent of respondents record backlogs of 30 days or less; 29 percent say it’s 30 to 60 days; another third acknowledge their time horizon extends at least 60 days.

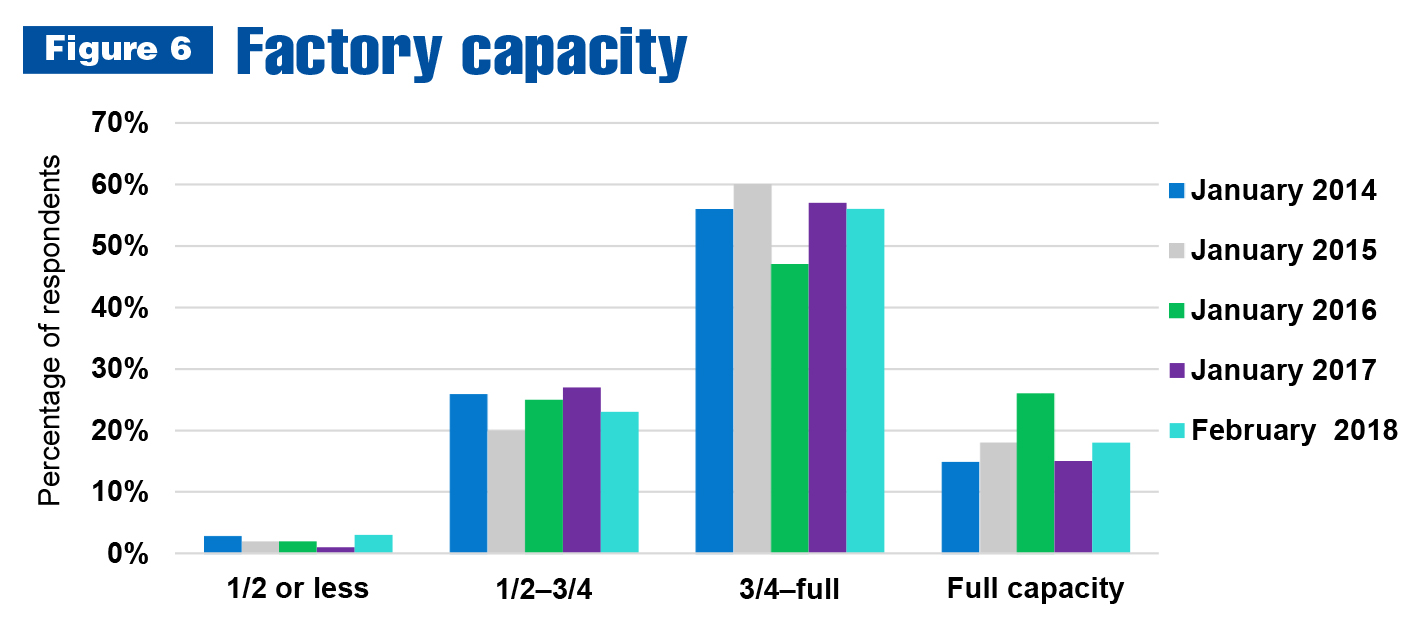

Seventy-four percent of reporting companies have little to no ability to increase workload above current capacity — barring a sizable business expansion or merger. Only 3 percent are functioning at less than 50 percent capacity.

Factors affecting business

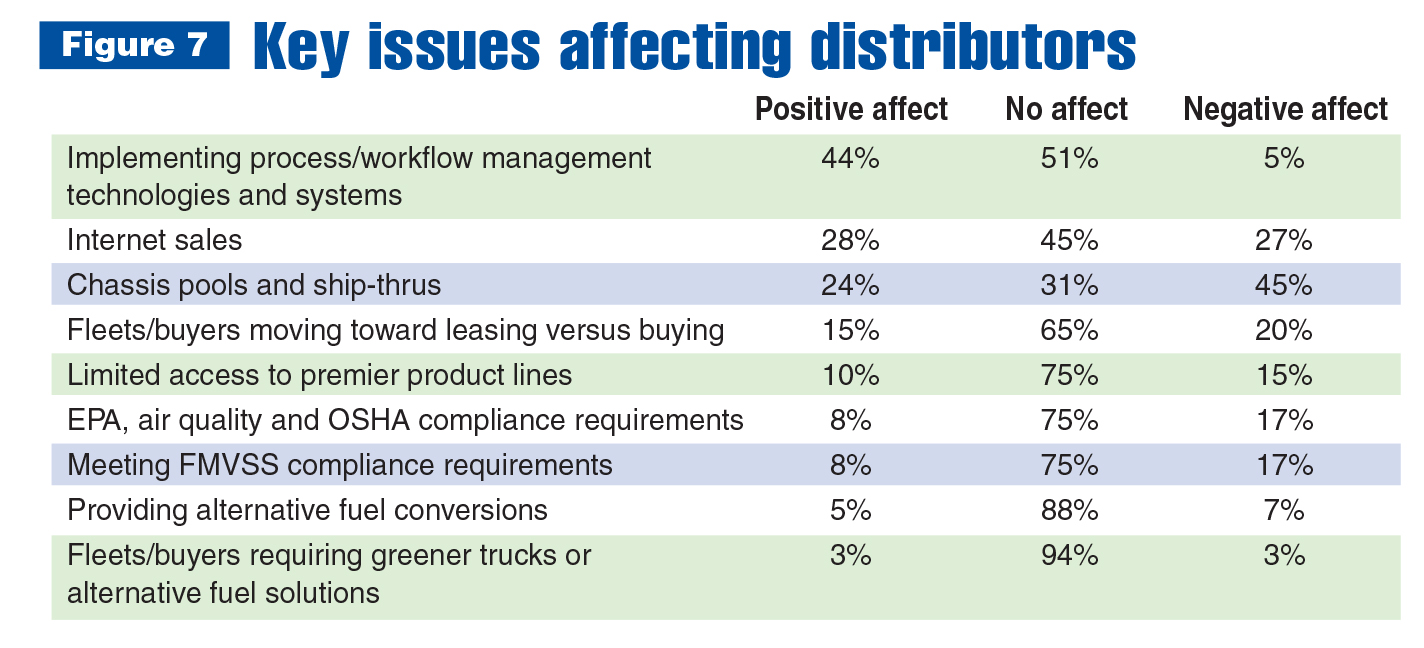

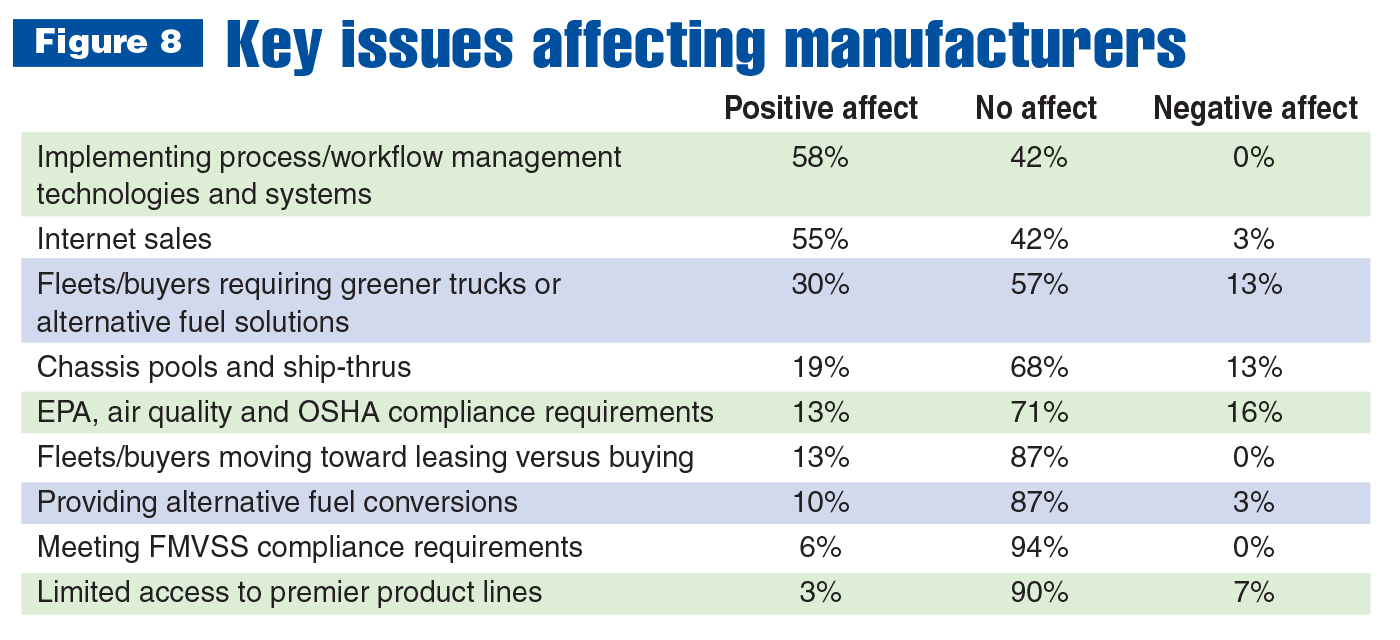

Companies in the work truck industry must adapt to a variety of market factors influencing business. Figures 7 and 8 isolate distributor and manufacturer perspectives toward key issues.

Implementation of process and workflow management technologies and systems clearly has the most positive affect on distributors. Chassis pools and ship-thrus are considered most unfavorable, followed by internet sales and fleets/buyers moving toward leasing versus buying. Responding distributor companies were most neutral toward fleets/buyers requiring greener trucks or alternative fuel solutions and providing alternative fuel conversions.

Implementing process and workflow management technologies was even more important to manufacturers than distributors, with internet sales a close second. Meeting Federal Motor Vehicle Safety Standard (FMVSS) compliance requirements was least influential, followed by limited access to premier product lines. Environmental Protection Agency (EPA), air quality and Occupational Safety and Health Administration (OSHA) compliance requirements have the most negative influence.

Industry challenges

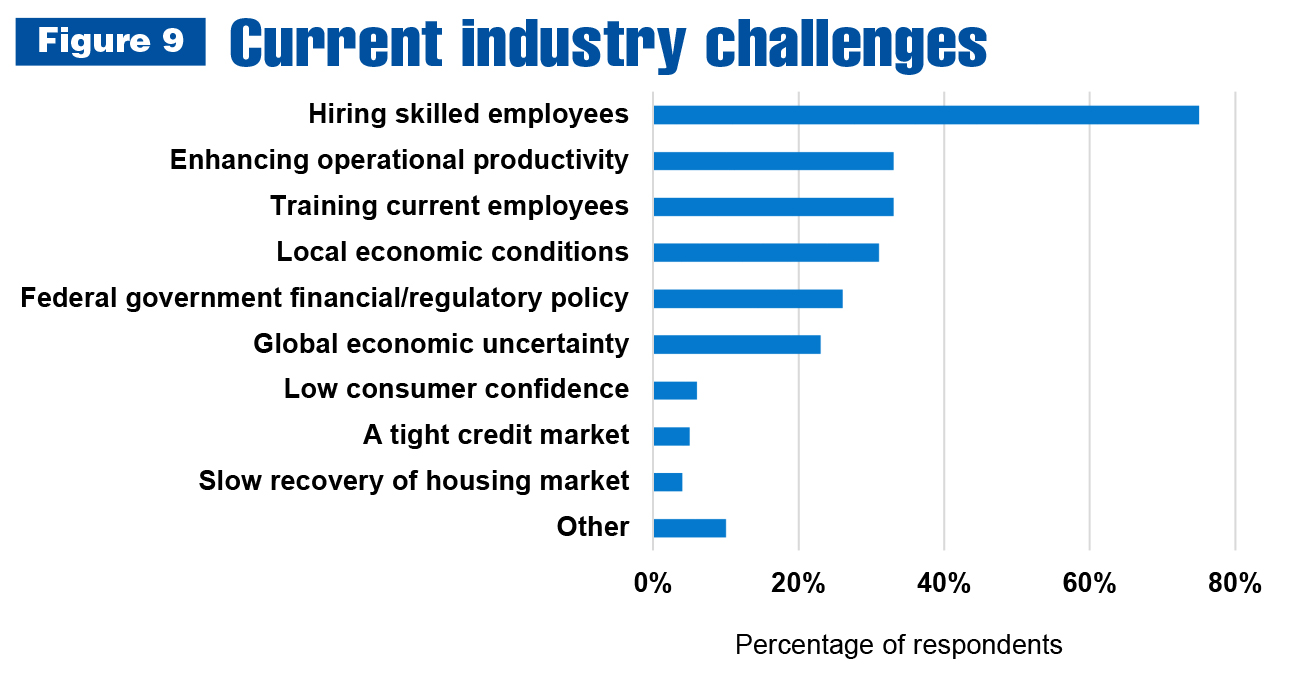

Despite the growth outlook, industry companies face challenges. Three quarters of survey respondents cited hiring skilled employees as one of the biggest concerns today. Training current employees and enhancing operational productivity are the other top issues noted. (Totals are not equal to 100 percent due to respondents’ ability to select multiple answers.)

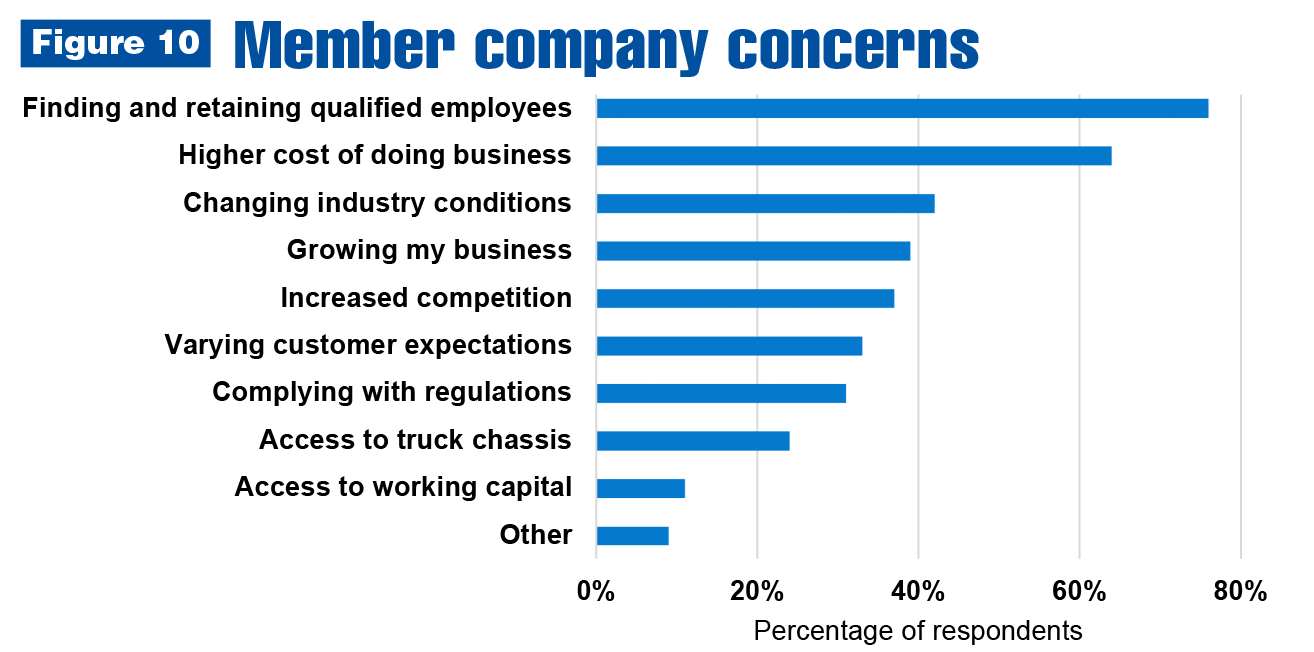

For 76 percent of reporting members, finding and retaining qualified talent is the biggest issue. Sixty-four percent feel pressure from the higher cost of doing business. Changing industry conditions (i.e., shifting customer and marketplace dynamics) create significant problems for more than 40 percent. (Totals are not equal to 100 percent due to respondents’ ability to select multiple answers.)

Success drivers

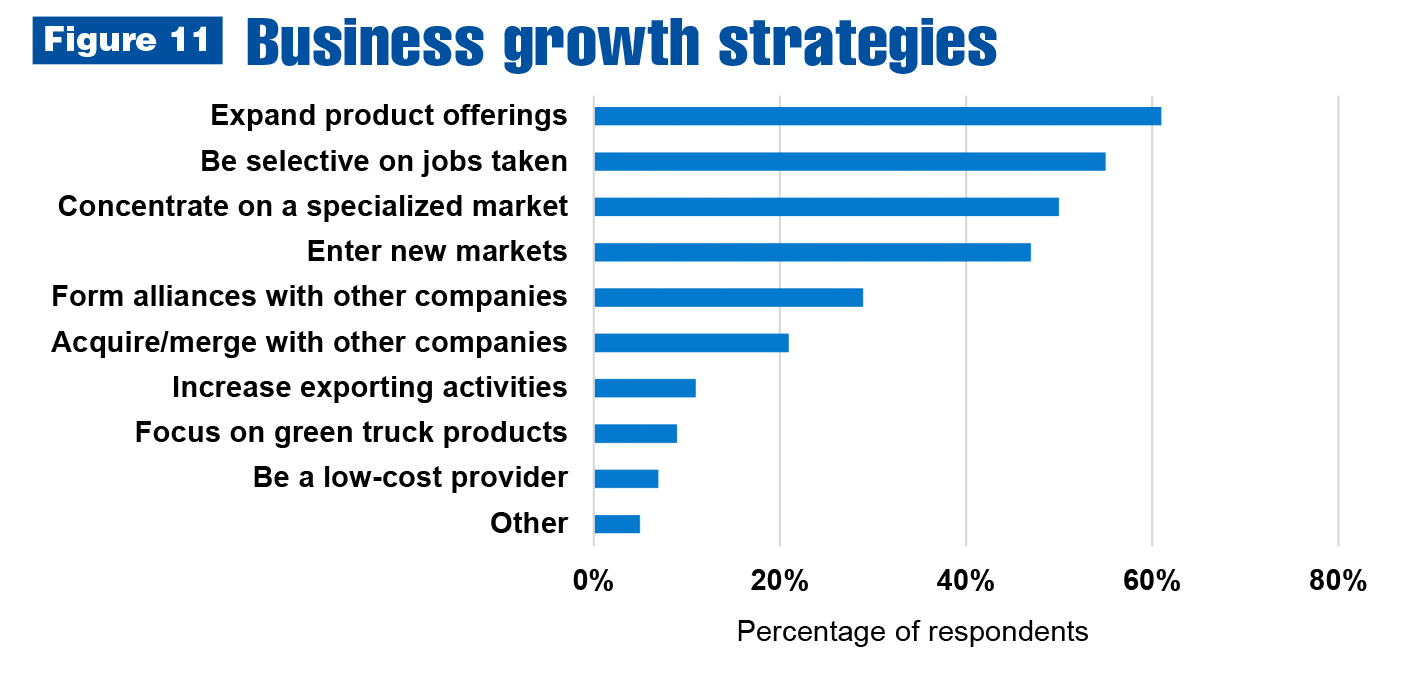

In terms of business growth, most common tactics involve expanding product offerings or product lines; being selective on jobs taken to maintain higher profit margins; and focusing on a specialized niche market. Other widely regarded approaches include entering new markets; forming alliances with other industry companies; and mergers or acquisitions. Least popular methods are being a low-cost provider and focusing on alternative fuel and green truck products. (Totals are not equal to 100 percent due to respondents’ ability to select multiple answers.)

Looking ahead

Moving forward, there are elements of opportunity and caution to consider. Distributor and manufacturer survey respondents listed a number of prospective ways their companies could benefit, such as:

- A comprehensive U.S. infrastructure program

- Servicing large truck dealer groups

- Producing regular, repetitive income (e.g., rental)

- Understanding how to conform with regulations

- Partnering with OEMs

- Strategic acquisitions

- Educating customers

- Building niche markets with exclusive products

- Connecting with growing regional companies that need work truck solutions

Beyond the common concerns stemming from government regulations and a lack of qualified employees, significant hurdles to the growth and long-term success of member companies include:

- Current political climate and financial uncertainty

- Limited production capacity

- Business consolidation

- Competition from major manufacturers and chassis pool upfitters

- Healthcare costs

For questions or more information on this survey, contact Joy Knesnik, NTEA communications manager, at joy@ntea.com.