By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the September 2017 edition of NTEA News.

The construction industry accounts for roughly 25 percent of all commercial truck and equipment purchases. As of 2016, U.S. construction expenditures totaled just under $1.2 trillion. Through the first six months of 2017, that economic sector is on pace to reach about $1.15 billion — a slight decrease from last year.

The drop is attributable to public sector spending. State and local construction expenditures were about $290 billion in 2016 — roughly 32 percent of private sector expenditures. Through June 2017, expenditures are anticipated to be a bit less than $250 billion. The $40 billion dollar decline is expected to be greater than the private sector increase.

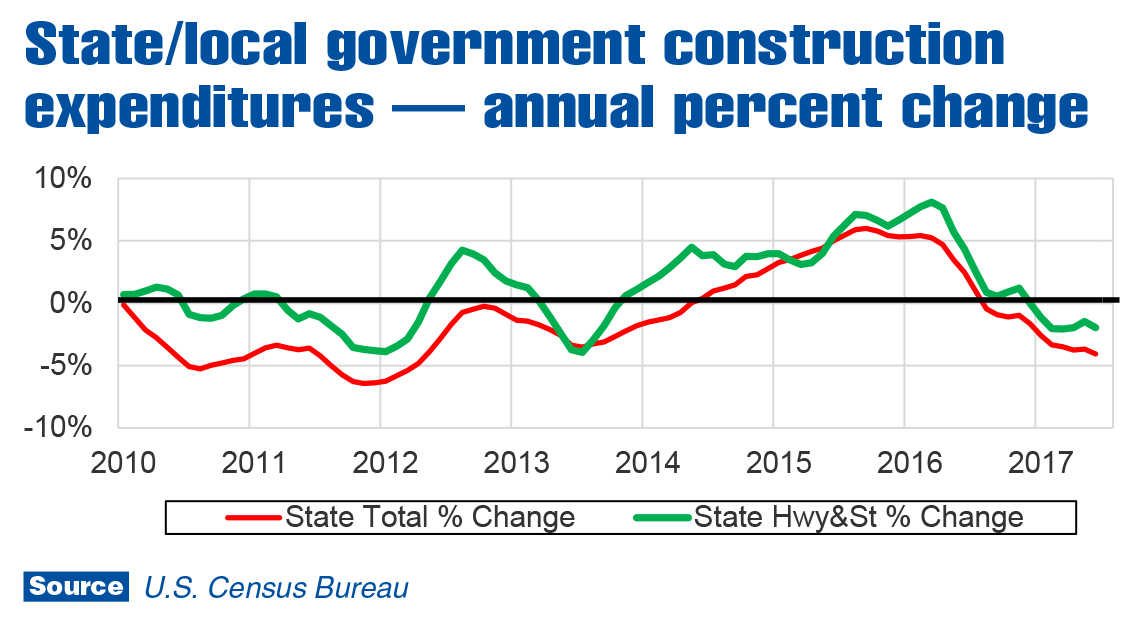

The two largest segments of state and local government construction spending are, in order, highway and street, and education. In an average year, highway and street accounts for about 33 percent of total expenditures. In the past couple years, education construction has been essentially flat — but this is not so for highway and street expenditures, as shown in the chart below.

Typically, when state and local tax revenues rise, construction expenditures follow suit. Tax revenues jumped in 2016, and are increasing again this year, so why are highway and street construction expenditures falling? Part of the decline can be attributed to two consecutive years of swift growth that didn’t leave much room in budgets for additional projects in 2016 and 2017. But there is more to the story.

In December 2015, Congress passed Fixing America’s Surface Transportation (FAST) Act — the core of which was a planned increase in Highway Trust Fund (HTF)-financed projects of $2.4 billion per year starting in fiscal 2017. FAST implementation was disrupted by a continuing resolution passed last December that mandated 2016 spending levels remain in place through April 2017.

As of August, FAST could not be funded because HTF was underfunded. This has become a continuing issue. HTF’s main funding source is the Federal Excise Tax (FET) on gasoline and diesel. FET has not been raised since 1993, and inflation has eroded its purchasing by 40 percent. As a result, Congress has transferred $140 billion to HTF from the general fund since 2008.

As FAST expectations have not been met, it’s likely congressional unwillingness to provide planned-for HTF funding has caused uncertainty among state and local government officials that’s affecting decisions to move forward with construction projects. From a work truck industry perspective, this is problematic. Construction projects halted or delayed due to funding uncertainty affect municipal fleet manager decision-making processes as well.

In June, a bipartisan group of legislators sent a letter to the House Ways and Means Committee. It requested the Committee come up with a long-term HTF funding solution when they pursue a major tax code overhaul this year.

State and local equipment expenditures continued rising in the first half of 2017. This indicates the uncertainty affecting construction expenditures has not yet extended to other areas of municipal government. Hopefully, action will be taken this year regarding HTF and infrastructure spending in general, that will alleviate uncertainty and put state and local government expenditures back on track.

For more industry market data, visit ntea.com/marketdata.